TrakInvest is a virtual social trading platform which is all about “Crowdsourcing of Financial wisdom” and helps in rewarding participants based on performance and insights in its decentralized economy. The platform currently offers 3 major advantages, which are:

1. Giving users the ability of sharing their investment expertise with other members of the network for a fee.

2. Provision of a crowdsourced sentiment, forecasting and prediction tools with the use of innovations in smart contracts, machine learning, NLP and artificial intelligence.

Ensuring a digital certification of programs in online trading.

For more information, users can access and explore the existing platform on www.trakinvest.com

However, the laying of solid foundations for the growth of new business models in investment insights and financial transaction technologies rest on the shift from a centralized technical infrastructure to a distributed, ecosystem-enabling platform. With regards to this shift, TrakInvest platform will have to utilize a blockchain technology to create a decentralized peer-to-peer ecosystem that orientates and incentivizes members of such community on performing value added services. In general, the full establishment and continuity of the virtual socio-trading environment depends on the rewards, incentives and insight tools which in a risk-free manner rewards for performance, sharing of investment insights and real-time trading data.

TrakInvest is making plans increase the scalability of the current platform by balancing the blockchain technology while the security and transparency levels is being enhanced. It is backed by a powerful strong tech stack and in which the ecosystem has a strong technical foot holding based on the strength of the Ethereum’s Open Community network. It is also backed by a highly-experienced management team and an advisory board. The global advisory board is mainly comprised of individuals and existing investors with strong global experience and exposure in technology, media, telecommunications, financial services and cryptocurrencies.

Simple put the platform is a 21stcentury emergent community that is developed to tackle the incessant challenge of the conformist methods of trading bonds and equities which has litanies of intermediaries.TrakInvest is best set up to implement this project as, TrakInvest Pte. Ltd. already has a strong three-year track record and has assembled up a community of 100,000+ in Asia consisting of futuristic developers with strong existing partnerships with corporates, universities, and governments in Asia. The community continues to provide instrumental trading data, insights, and sentimentalities by dynamically trading on the platform. TrakInvest will move to Blockchain and issues its utility TRAK token. The token utilities will include but not limited to tokenized data ownership, tokenized reputation system, and tokenized certifications.In 2018, TrakInvest will introduce its second generation of “crowd sourced” gushes tools and models developed using proprietary trading data and behavior collected over the past 3 years. You sure cannot get all the information in this one piece, thus to get detailed and background information about the workings of the platform and paraphernalia, download ‘White Paper’ at https://trakinvest.ai/files/ti-whitepaper.pdf and find out for yourself what technology is changing with this innovation.

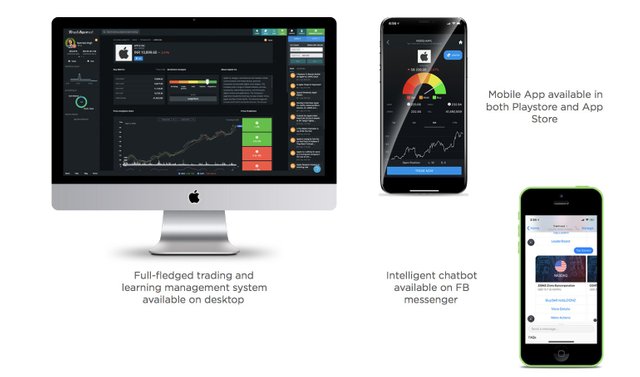

The project is a huge one. To achieve it single-handedly will be a mere façade thus, the platform is offering the platform’s coinfor sale to allow investors and other participants explore the huge benefits inherent in the platform. The diagram bellows shows how the platform appears on different devices to show how compatible the project is.

The platform will be fueled with the usage of the platform; hence the token that will be employed to interrelate and interconnect within the ecosystem is the TRAK token-a complete ERC20 token with smart contract directly built on the platform. The illustration that follows shows how the platform interconnects with divergent and convergent variables.

TrakInvest ICO Details ?

Token Name : TRAKWebsite : www.trakinvest.com

Type of Offer : Initial Coin Offering (ICO)

Total Tokens : 155,294,118

Accepted Currencies : Ether (ETH)

ERC20 Token : Yes

Token Main Sale Price : 1ETH = 1093 TRAK/ 1 TRAK Token = 0.000915 ETH

ICO Pre-Sale Dates : 8:00AM; December 16th 2017 (SST) — 8:00PM; January 19th 2018 (SST)

ICO Sale Dates : 8:00AM; January 19th 2018 (SST) — 8:00PM; February 3rd 2018 (SST)

Offering Structure : 66,000,000 tokens available

ICO

=>Tranch 4–11,000,000 tokens : 4.31% discount | Starts on 8p.m January 19th 2018.

=>Tranch 5–11, 000,000 tokens : 2.25% discount | Starts automatically after Tranch 4 ends.

=>Tranch 6–11,000,000 tokens : 1.09% discount | Starts automatically after Tranch 5 ends.

In the 100% Token allocation, different percentages are distributed to individuals such as; Partnerships and early adopters, Management Team, Board of Advisors, M&A Expansion and BuyBacks, Bounty, Referrals & Community Blog and Pre-Sale & ICO.

e.g. in a token allocation of $100000000, the percentage goes thus:

Partnerships & early adopters: 5% = $5,000,000

Management Team: 23% = $23,000,000

Board of Advisors: 10% = $10,000,000

M&A Expansion and BuyBacks: 15% = $15,000,000

Bounty, Referrals & Community Blog: 5% = $5,000,000

Pre-Sale & ICO: 42% = $42,000,000.

=>N.B: Discount in each tranch is applicable until the end of the allocated tokens or allocated time being sold out. Any of which comes earlier will be regarded.

TrakInvest AI Engine: Unlocking Market Insights from Heterogenous Social Data.

It is no news that the creation of the Internet and the World Wide Web has resulted in the explosive great growth of online prediction communities and rich social investing datasets e.g. forum discussions, financial news, blogs, social media feeds, telegram channels and so on. The promise of providing accurate measures of investor trust is based on these datasets and makes it possible to evaluate investors not just by their popularity but by their historic performances and recommendations.

TrakInvest AI Engine allows to overcome challenges such as; the scattering of numerous datasets across many different sources, the vast differences of data sources in structure and organization and the generation of data through these sources at a very fast rate. This challenge is overcome by creation of the TrakInvest Knowledge Graph (TKG)- which involves all heterogenous datasets of interest to be viewed in a curated and modified manner. The TrakInvest AI Engine has three key initiatives which includes;

1. TrakInvest Knowledge Graph (TKG)

2. Sentiment Engine

3. Continuous Learning.

In a schematic view, the TrakInvest Knowledge Graph is built by the engine in which is done by automatically all structured and unstructured datasets of interest. After this, the estimation of crowd sentiments is done by the engine over various other components of TKG such as investor sentiments over securities, companies etc. Lastly, using a continuous learning mechanism will help to estimate the predictive power of such sentiments against actual market.

1. TrakInvest Knowledge Graph (TKG):

Knowledge Graphs (KGs) are multi-relational graphs which consists of relationships between entities. It came as a result of having a very effective way of extracting and organizing knowledge from large unstructured datasets. Some leading search engines such as Google, Wikipedia and Bing make use of such KGs to improve web search experience. The TKG construction engine scans continuously a set of new sites, social media feeds, online discussion forums etc.to build the TKG. The TKG apparently consist of characters such as investors, analysts, securities, institutions and cryptocurrencies. The following are sub problems TrakInvest’s AI Engine solves to build the TKG:

a. Predicate Scheme Induction

b. Instance Population

c. Overcoming Scarcity using Deep Reinforcement Learning

d. Source Credibility Estimation.

e. Natural Language KG Interference

2. Sentiment Engine:

Sentiments are read by TrakInvests sentiment engine from several unstructured text data and such entities and relationships are aggregated over in the TKG. An example is when an analysis recommendation for a particular security which has evolved over time is extracted and stored by the sentiment engine. In this same manner, an estimation of how crowd sentiments over a particular cryptocurrency has changed over time is done by the engine. Therefore, the TrakInvest Knowledge Graph in conjunction with sentiment over its various components helps in providing a holistic overview of such market conditions which covers various entities and stakeholders earlier stated above. Most importantly, it is very necessary to continuously update and expand this graph in order to change the world condition.

3. Continuous Learning:

The TI-STOCK score, TI-ANALYST score and TI-TRADER score are known to supplement the TKG and sentiment analysis engine in which each of them provide a time sensitive quantitative metric where stocks, analysts and traders can be ranked. The continuous learning uses State-of-art Network Analysis, Deep Learning over Graphs, and Graph Embedding Techniques to estimate these scores. Computation and updating of these scores can be done with the aid of a continuous learning mechanism. The first step is to parameterize accurately the scores in which the updated parameters are correlated with the predictive power of the corresponding variable against real market signals. In summary, through this learning mechanism, it will be quite possible not only to estimate overall competency of an analyst but also to learn about biases in a data-driven manner.

Tokenomics ?

TrakInvest Token (‘TRAK’ token) is a utility token which is used to perform quite a variety of activities on the platform. The TRAK token demand is driven based on the strong pipeline of existing contracts with leading contracts with leading corporates and universities. As aforementioned, the utility tokens which are used to engage in TrakInvest services are primarily three which are i.) Tokenized data ownership. ii.) Tokenized reputation system iii.) Tokenized certifications.

ROADMAP:

Website : https://trakinvest.ai/

Business Whitepaper : https://trakinvest.ai/files/ti-whitepaper.pdf

Technical Whitepaper : https://trakinvest.ai/files/trakinvest-ai-engine.pdf

Twitter : https://twitter.com/TrakInvest

Telegram : https://t.me/joinchat/GLe6KhCAs5bw4x6bNBYARw

AUTHOR: Mex89

ETH: 0xf02df1350820ecc4C58BF067739900A50722D5Ca